Some Known Details About Invoice Factoring

Table of ContentsUnknown Facts About Invoice FactoringInvoice Factoring Fundamentals ExplainedThe Basic Principles Of Invoice Factoring

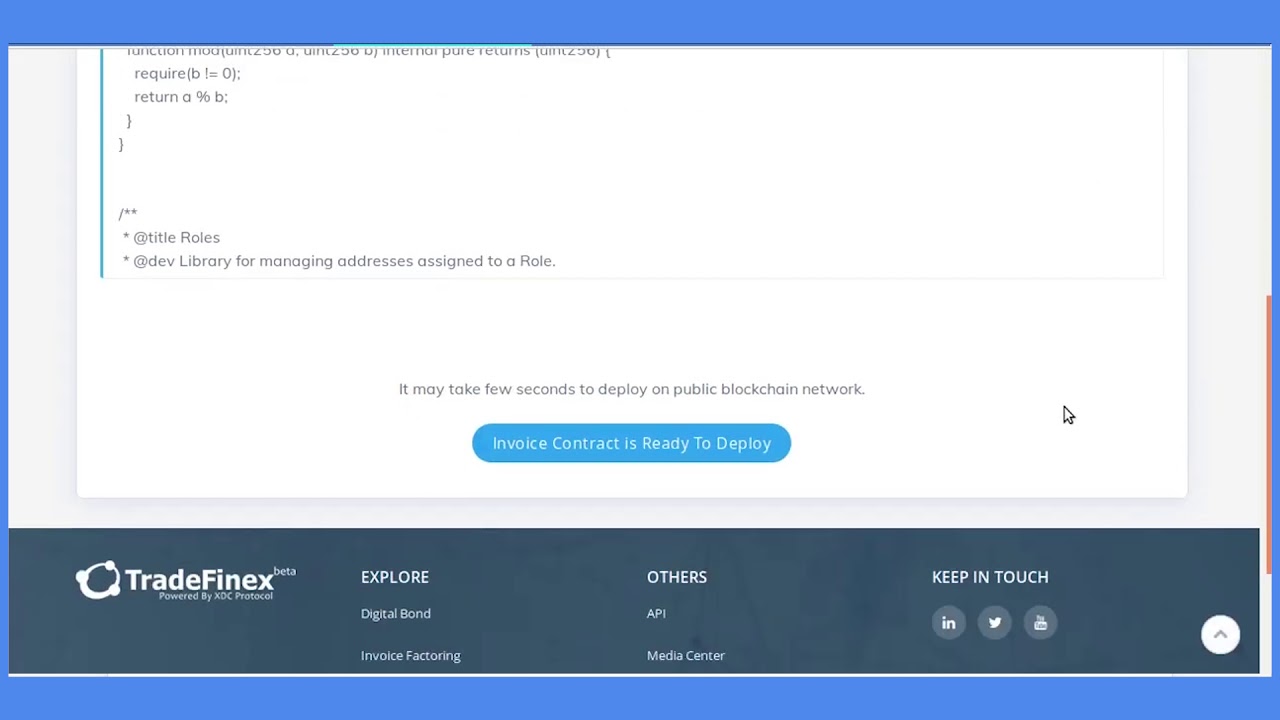

Likewise, many large banks such as banks are anticipated to follow a general principle of treating clients rather. A number of cutting-edge brand-new factoring firms have actually arised offering a brand-new breed of factoring item, typically online. One instance is place factoring, in which you can choose to fund just a single billing.As such, both spot factoring and careful factoring are comparable to pay-as-you-go (PAYG) factoring, which has evident cost and flexibility advantages if your cashflow difficulties are periodic. Sometimes, your invoices are financed in a competitive bidding process circumstance, called invoice trading. Billing money is a complex location of organization financing, so we've assembled an extensive Billing Money Guide to help you discover the ideal invoice financing for your company.

It's an usual question, and permanently factor: "Does invoice factoring scare my clients?" You do not want clients to think you're having capital concerns as well as possibly pull their service. There are a great deal of reasons individuals utilize billing factoring, however. One is to improve capital, however companies additionally use invoice factoring to money new company ventures or contracts, hire talent, purchase new equipment, and also extra.

Factris provides a credit line to your service with almost prompt capital and at the cheapest cost. Ignore collecting your unpaid billings and start concentrating on building your company. Rest easy recognizing you'll never ever lose cash from unanticipated occasions when you factor a billing.

Not known Details About Invoice Factoring

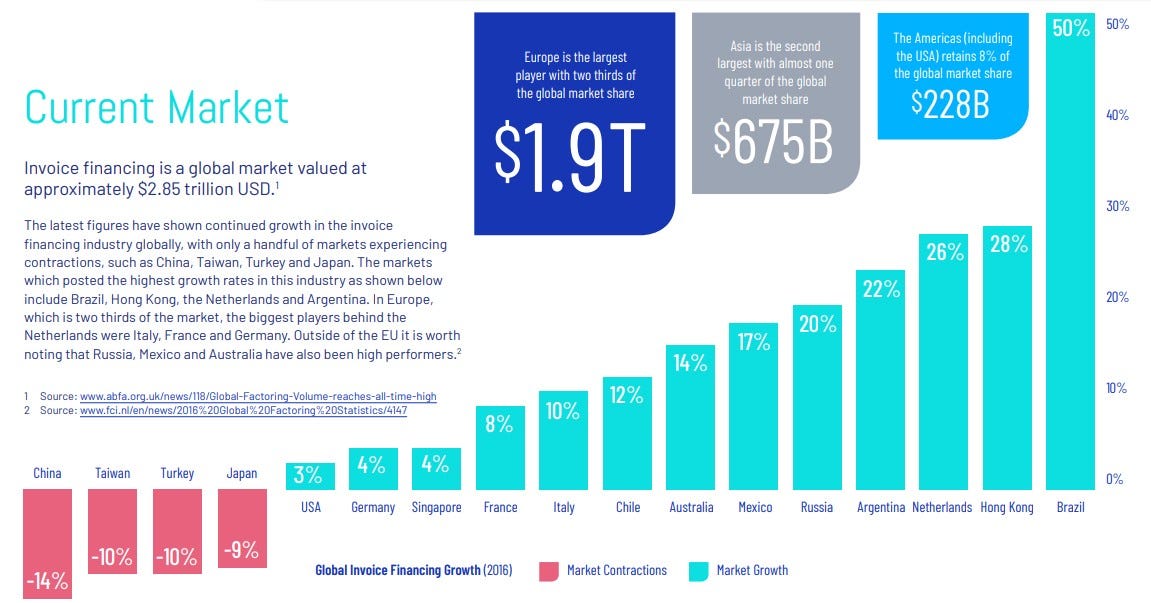

Invoice financing is a sort of short-term loaning that permits businesses to release their sales billings to a finance company and also receive a development before they have actually been paid. invoice factoring. In most cases, companies get themselves into financial debt due to late repayments from clients or needing to await the repayment terms to gap.

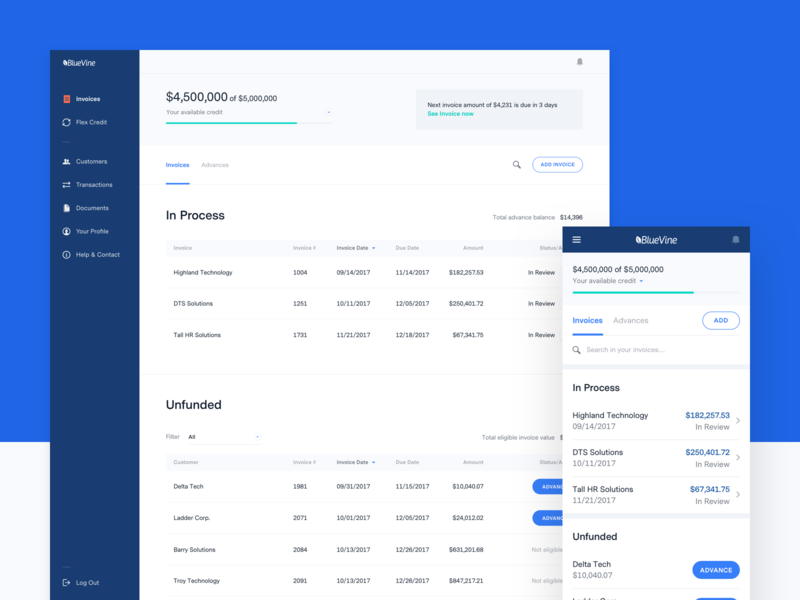

If you have any type of questions or need additional information as to which option is best for you and your company please do not hesitate to call us. With invoice money, the customer has control of collections, whereas with billing factoring the company acquiring the unsettled billings manages collections. In both situations, companies can anticipate an advancement of approximately 95% on their exceptional invoices, with the money business taking a little fee and also you receiving the remaining balance after the client has paid - invoice factoring.

The lending institution will advance you a particular summarize front. Then as soon as the customer pays, you'll obtain the staying balance minus your service provider's cost. With invoice financing, your company is in charge of gathering any kind of superior money owed to you by your customers or clients. In a lot of cases, your invoice money supplier can sync up browse around these guys to your receivables system so when your customer pays, they immediately subtract their fee prior to making the equilibrium available to you. Then, you need to comply with up with Judy for payment, she pays within the month, utilizing bank transfer for the sum total of 5,000. You keep 850 for yourself and send the staying 4,150 to the invoice funding firm you picked. In total, you obtain 97% of the billing value4,850, with invoice funding business receiving their cost of 150.

Your picked factoring company will handle the billings in between you and also your customer. The factoring company will certainly progress funds upfront no matter if the consumer has paid or not yet. Once the client has paid, your factoring business will gather the debt, deposit the staying balance to you and take their cost.

Some Of Invoice Factoring

It's then the aspects job to gather the complete amount from your customer. When gathered, you'll receive the staying amount from your billing quantity minus the charge that the factoring company fees you for its service. Your customer deals with the factoring company to make the payment, as opposed to you.

Several businesses choose factoring if they require to deal with a whole lot of consumers that get on a 60 to 90 days repayment contract. It suggests they have the back up of one more company to help them get the cash owed to try this site them - invoice factoring. See Invoice Factoring for more details.