Not known Details About Invoice Factoring

Table of Contents5 Simple Techniques For Invoice FactoringThe Basic Principles Of Invoice Factoring The Best Guide To Invoice Factoring

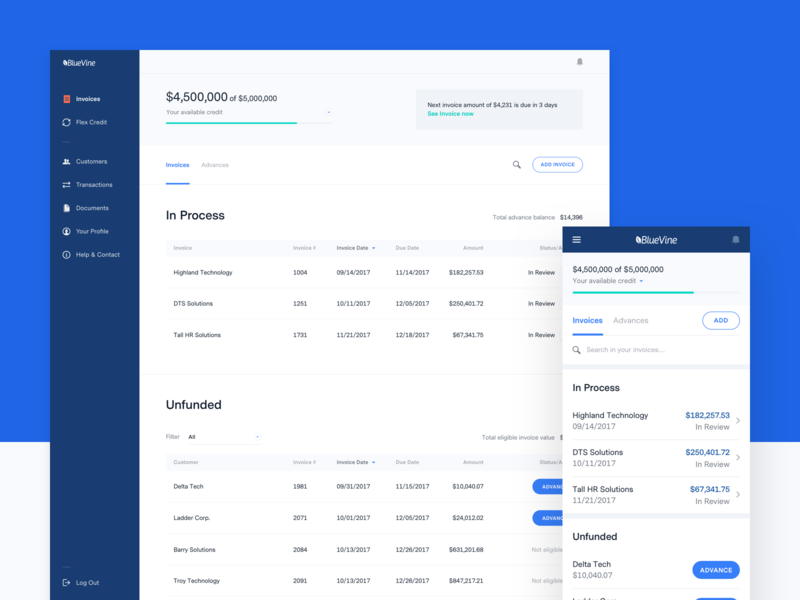

Likewise, lots of big banks such as financial institutions are expected to comply with a basic principle of treating clients rather. A number of ingenious brand-new factoring companies have emerged offering a new breed of factoring item, often online. One example is place factoring, in which you can pick to fund simply a single billing.Therefore, both spot factoring and also selective factoring are comparable to pay-as-you-go (PAYG) factoring, which has apparent cost and also versatility advantages if your cashflow challenges are recurring. In many cases, your billings are financed in an affordable bidding scenario, called invoice trading. Invoice finance is an intricate area of company finance, so we have actually assembled an extensive Billing Financing Guide to assist you find the ideal billing financing for your service.

It's a common inquiry, and also completely factor: "Does invoice factoring scare my consumers?" You do not want clients to assume you're having cash flow issues and potentially pull their organization. There are a lot of factors individuals use billing factoring, though. One is to boost capital, yet companies additionally make use of invoice factoring to fund brand-new service endeavors or agreements, work with ability, spend in brand-new equipment, and also more.

Factris gives a credit score line to your service with virtually prompt capital and also at the lowest expense. Forget gathering your unsettled invoices and also start focusing on building your service. Relax easy understanding you'll never lose cash from unanticipated occasions when you factor a billing.

The Basic Principles Of Invoice Factoring

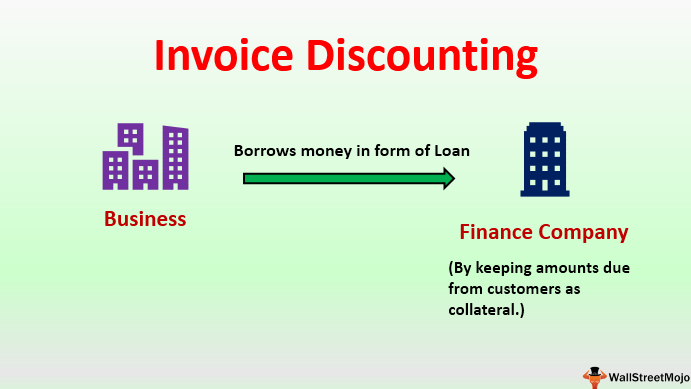

Billing financing is a sort of temporary loaning that permits companies to release their sales billings to a money provider as well as receive an advancement before they have actually been paid. invoice factoring. In many instances, companies get themselves right into financial obligation because of late repayments from customers or having to wait on the settlement terms to lapse.

If you have any inquiries or need further details as to which option is best for you as well as your business please really feel totally free to call us. With invoice financing, the client has control of collections, whereas with invoice factoring the business buying the unsettled billings handles collections. In both cases, businesses can anticipate a development of up to 95% on their outstanding invoices, with the money business taking a little cost and you getting the staying balance after the customer has paid - invoice factoring.

The lender will certainly advance you a particular summarize front. Then when the client pays, you'll receive the continuing to be balance minus your service provider's charge. With invoice money, your business is in charge of collecting any exceptional money helpful site owed to you by your customers or clients. In several situations, see this site your invoice finance service provider can sync up to your accounts receivable system so when your client pays, they instantly subtract their cost before making the equilibrium available to you. After that, you need to comply with up with Judy for settlement, she pays within the month, utilizing bank transfer for the complete amount of 5,000. You maintain 850 for yourself as well as send the continuing to be 4,150 to the billing funding business you selected. In overall, you receive 97% of the billing value4,850, with billing financing firm receiving their charge of 150.

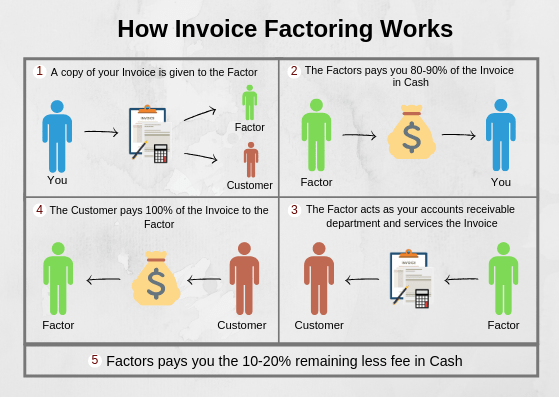

Your chosen factoring firm will handle the invoices between you and also your client. The factoring firm will certainly advance funds in advance no issue if the customer has paid or not yet. Once the customer has paid, your factoring company will certainly collect the financial debt, deposit the staying equilibrium to you as well as take their fee.

Everything about Invoice Factoring

It's after that the elements work to accumulate the total from your client. Once collected, you'll get the remaining sum from your billing amount minus the cost that the factoring firm charges you for its solution. Your customer take care of the factoring company to make the repayment, rather than you.

Many businesses opt for factoring if they need to take care of a great deal of clients who get on a 60 to 90 days payment contract. It suggests they have the back up of another company to help them obtain the cash owed to them - invoice factoring. See Billing Factoring for additional information.